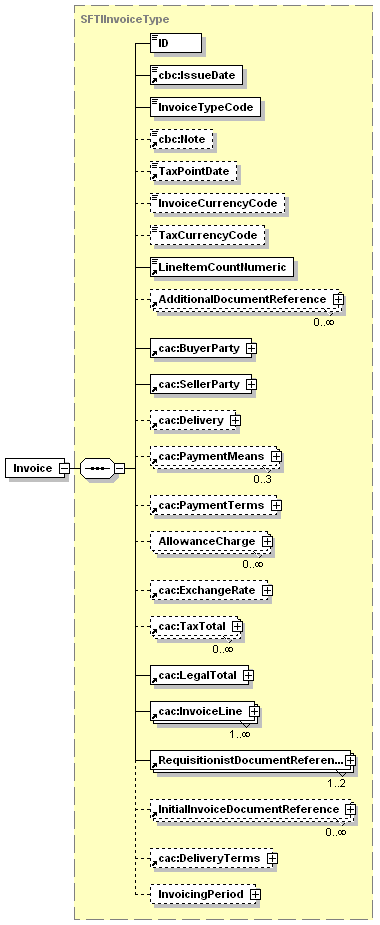

Invoice

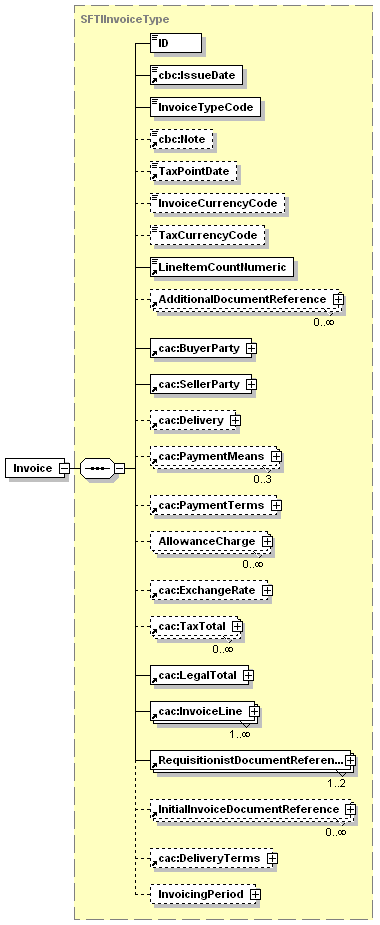

AdditionalDocumentReference

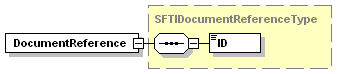

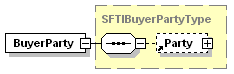

cac:BuyerParty

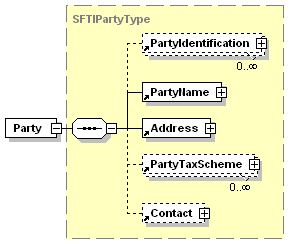

cac:Party

cac:PartyIdentification

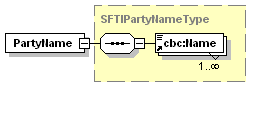

cac:PartyName

cac:Address

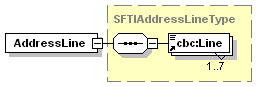

cac:AddressLine

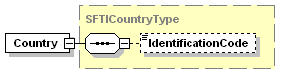

cac:Country

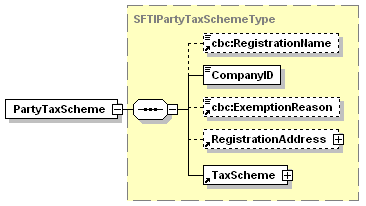

cac:PartyTaxScheme

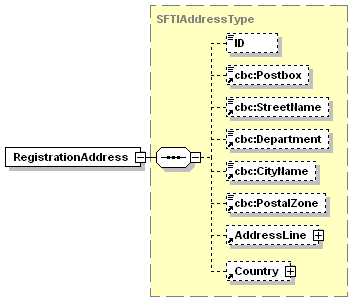

cac:RegistrationAddress

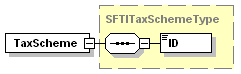

cac:TaxScheme

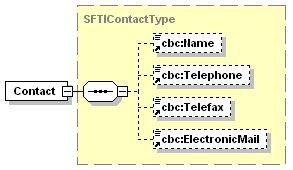

cac:Contact

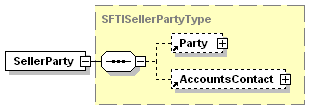

cac:SellerParty

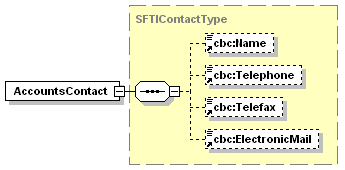

cac:AccountsContact

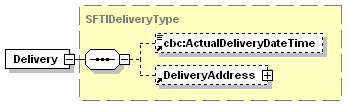

cac:Delivery

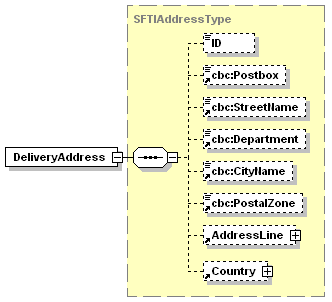

cac:DeliveryAddress

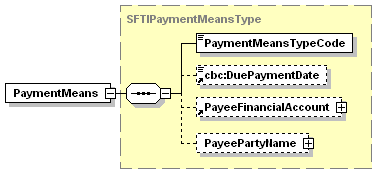

cac:PaymentMeans

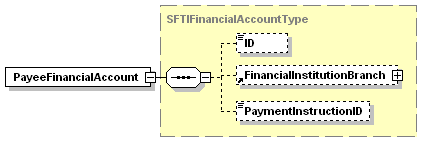

cac:PayeeFinancialAccount

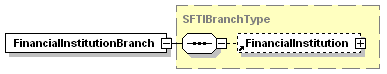

cac:FinancialInstitutionBranch

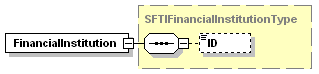

cac:FinancialInstitution

cac:PayeePartyName

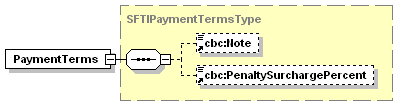

cac:PaymentTerms

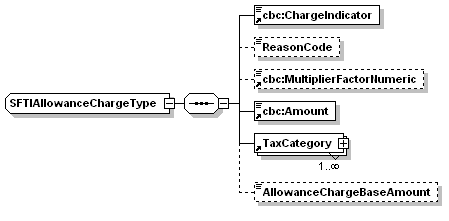

AllowanceCharge

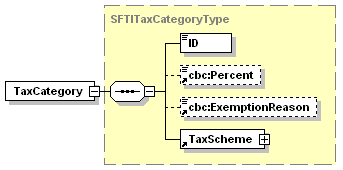

cac:TaxCategory

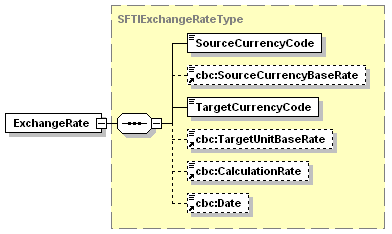

cac:ExchangeRate

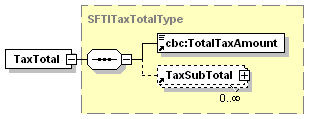

cac:TaxTotal

cac:TaxSubTotal

cac:LegalTotal

cac:InvoiceLine

cac:OrderLineReference

cac:OrderReference

cac:DespatchLineReference

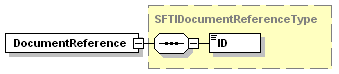

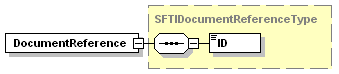

cac:DocumentReference

cac:AllowanceCharge

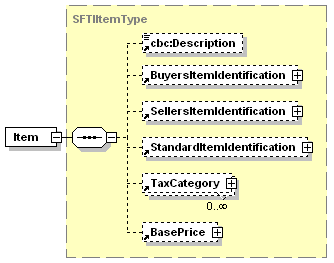

cac:Item

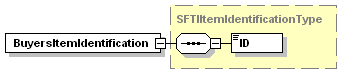

cac:BuyersItemIdentification

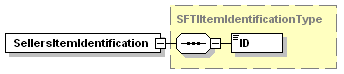

cac:SellersItemIdentification

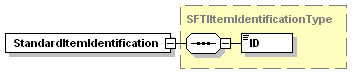

cac:StandardItemIdentification

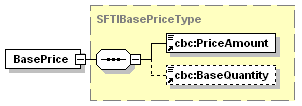

cac:BasePrice

RequisitionistDocumentReference

InitialInvoiceDocumentReference

cac:DeliveryTerms

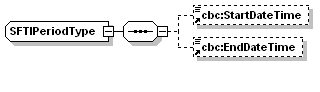

InvoicingPeriod

| Field name | Type | Cardinality | Comment | Basic content |

| ID | Identifier | 1 | VAT req. no. 2 - a sequential number based on one or more series that uniquely identifies the invoice. In Sweden, accounting practice tend to require the number to be unique for the supplier during one financial year, that is in order to secure uniqueness for the whole storage period supplier + invoice number + invoice date, at least, would be needed as key. With reference to the VAT requirement the supplier is recommended to maintain unique invoice numbers for his whole period of storage. | B |

| cbc:IssueDate | Date | 1 | VAT requirement no. 1 - date of issue | B |

| InvoiceTypeCode | Code | 1 | The interpretation of the transaction as ”invoice” or ”credit note” is coded as follows (ref UN/Edifact 1001) - note this is not a VAT requirement, however the element is significant also in this respect: 380 – invoice 381 – credit note | B |

| cbc:Note | Text | 0..1 | Textual information regarding the whole invoice. If specific elements exist, they should be instead of the text. For credit note, specify the reason for crediting if it does not follow from information in other elements. | B |

| TaxPointDate | Date | 0..1 | VAT req. no. 7 - the date on which the supply of goods or of services was made or completed or the date on which the payment on account was made insofar as that a date can be determined and differs from the date of the issue of the invoice. The Swedish Tax Authority has stated that, in case of supply of goods, it is the actual date of delivery - to be interpreted as the day the seller delivers the goods and not when the buyer receives them. This can differ from the terms of delivery. In case of service it is sufficient to state the month if a more precise date cannot be given. For continuous deliveries of goods and services state the invoicing period instead. | B |

| InvoiceCurrencyCode | Code | 0..1 | Currency code according to ISO 4217. If the information is missing, invoice currency is the home currency of the country where the invoice issuer is registered. | B |

| TaxCurrencyCode | Code | 0..1 | VAT requirement. If the invoice is expressed in other currency than the tax subject's official accounting currency, and the accounting currency is other than Swedish krona or euro, the tax amount is to be expressed also in the accounting currency. If the tax subject has a different accounting currency than Swedish krona or euro, and the invoicing currency is other than Swedish krona, the tax amount is to be expressed also in Swedish krona. In case of conversion, also the exchange rate is required. | B |

| LineItemCountNumeric | Numeric | 1 | Check total. Formula: COUNT (”Invoice line number”) | B |

| Class name | Type | Cardinality | Comment | Basic content |

| AdditionalDocumentReference | Document Reference | 0..n |

Reference to agreement/contract when framework agreement applies.

Supplier's reference to invoiced object - it could be a subscription no., telephone no., petrol credit card no., etc, as applicable.

In case delivery notes exist they should be stated for verification by the buyer. Delivery notes are not to be used as substitute for specification in the invoice.

- If only one delivery note applies, it is specified here (on invoice level).

- If several delivery notes apply, they are specified per invoice line.

Use the following codes to separate between the various kinds of reference:

CT = agreement/contract

ACD = supplier's reference to invoiced object

DQ = delivery note

ATS = URN (Uniform Resource Name) of a graphic object associated to the invoice (e.g. scanned invoice image)

In an XML message this is specified as illustrated by the following example:

|

B |

| cac:BuyerParty | Buyer Party | 1 | B | |

| cac:SellerParty | Seller Party | 1 | B | |

| cac:Delivery | Delivery | 0..1 | B | |

| cac:PaymentMeans | Payment Means | 0..3 | B | |

| cac:PaymentTerms | Payment Terms | 0..1 | B | |

| AllowanceCharge | Allowance Charge | 0..n | B | |

| cac:ExchangeRate | Exchange Rate | 0..1 | VAT requirement. If the tax amount has to be converted to and shown in a currency different from the invoicing currency. | B |

| cac:TaxTotal | Tax Total | 0..n | B | |

| cac:LegalTotal | Legal Total | 1 | B | |

| cac:InvoiceLine | Invoice Line | 1..n | B | |

| RequisitionistDocumentReference | Document Reference | 1..2 | The requisitionist's reference is defined by the buyer for the sole purpose of forwarding a received invoice to the correct person/unit in charge within the buyer's organisation. This reference may be used for per transaction or used repeatedly in invoices (or periodic invoices) - a guide will be made separately. Normally only one reference should be used. Requisitionist's reference no. 2 is used only if Requisitionist's reference no.1 is not administered centrally in buyer's organisation. It can be used to identify an organisational unit, a project, etc. | B |

| InitialInvoiceDocumentReference | ||||

| cac:DeliveryTerms | Delivery Terms | 0..1 | Information on how the delivery was made; means of delivery; etc. | B |

| InvoicingPeriod | Period | 0..1 | The period is to be stated in case of periodic invoicing and for continuous supply of goods and services. This period information applies to the whole invoice, alternatively the relevant delivery times can be stated per invoice line. Cf. also tax point date. A period is also needed in credit notes crediting several invoices when the initial invoices are not referred to individually (and this is in agreement with the Tax Authority's requirements). See comment to ”Invoice reference” | B |

| Class name |

| <Invoice xmlns="urn:sfti:documents:BasicInvoice:1:0" xmlns:cac="urn:sfti:CommonAggregateComponents:1:0" xmlns:cbc="urn:oasis:names:tc:ubl:CommonBasicComponents:1:0" xmlns:ccts="urn:oasis:names:tc:ubl:CoreComponentParameters:1:0" xmlns:cur="urn:oasis:names:tc:ubl:codelist:CurrencyCode:1:0" xmlns:sdt="urn:oasis:names:tc:ubl:SpecializedDatatypes:1:0" xmlns:udt="urn:oasis:names:tc:ubl:UnspecializedDatatypes:1:0" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"> <ID> 12345</ID> <cbc:IssueDate> 2005-08-13</cbc:IssueDate> <InvoiceTypeCode> 380</InvoiceTypeCode> <cbc:Note> Information kan anges här för hela fakturan</cbc:Note> <TaxPointDate> 2005-08-13</TaxPointDate> <InvoiceCurrencyCode> SEK</InvoiceCurrencyCode> <TaxCurrencyCode> SEK</TaxCurrencyCode> <LineItemCountNumeric> 2</LineItemCountNumeric> +<AdditionalDocumentReference> +<cac:BuyerParty> +<cac:SellerParty> +<cac:Delivery> +<cac:PaymentMeans> +<cac:PaymentTerms> +<AllowanceCharge> +<cac:ExchangeRate> +<cac:TaxTotal> +<cac:LegalTotal> +<cac:InvoiceLine> +<RequisitionistDocumentReference> +<InitialInvoiceDocumentReference> +<cac:DeliveryTerms> +<InvoicingPeriod> </Invoice> |

Reference to agreement/contract when framework agreement applies.

Supplier's reference to invoiced object - it could be a subscription no., telephone no., petrol credit card no., etc, as applicable.

In case delivery notes exist they should be stated for verification by the buyer. Delivery notes are not to be used as substitute for specification in the invoice.

- If only one delivery note applies, it is specified here (on invoice level).

- If several delivery notes apply, they are specified per invoice line.

Use the following codes to separate between the various kinds of reference:

CT = agreement/contract

ACD = supplier's reference to invoiced object

DQ = delivery note

ATS = URN (Uniform Resource Name) of a graphic object associated to the invoice (e.g. scanned invoice image)

In an XML message this is specified as illustrated by the following example:

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

| <AdditionalDocumentReference> <cac:ID identificationSchemeAgencyName="SFTI" identificationSchemeID="CT"> 123456</cac:ID> </AdditionalDocumentReference> |

| Field name | Type | Cardinality | Comment | Basic content |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:Party | Party | 0..1 | B |

| Class name |

| Invoice |

| <cac:BuyerParty> <cac:Party> <cac:PartyIdentification> <cac:ID identificationSchemeAgencyID="9"> 7365565626575</cac:ID> </cac:PartyIdentification> <cac:PartyName> <cbc:Name> Lillsjö kommun</cbc:Name> </cac:PartyName> +<cac:Address> +<cac:PartyTaxScheme> <cac:Contact> <cbc:Name> Anders Johnsson</cbc:Name> <cbc:Telephone> 0123123456</cbc:Telephone> <cbc:Telefax> 0123316547</cbc:Telefax> <cbc:ElectronicMail> a@b.se</cbc:ElectronicMail> </cac:Contact> </cac:Party> </cac:BuyerParty> |

| Field name | Type | Cardinality | Comment | Basic content |

| Class name | Type | Cardinality | Comment | Basic content |

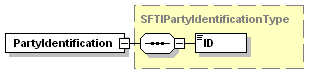

| cac:PartyIdentification | Party Identification | 0..n | Use of code is optional, but it is instrumental to a more extensive use of electronic document exchange. When code is used, each party shall be free to chose the own identification. | |

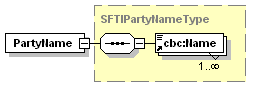

| cac:PartyName | Party Name | 1 | VAT requirement no. 5 | B |

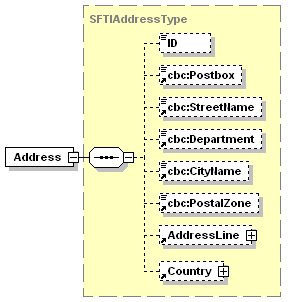

| cac:Address | Address | 1 | VAT requirement no. 5 | B |

| cac:PartyTaxScheme | Party Tax Scheme | 0..n | B | |

| cac:Contact | Contact | 0..1 | B |

| Class name |

| cac:BuyerParty |

| cac:SellerParty |

| <cac:Party> <cac:PartyIdentification> <cac:ID identificationSchemeAgencyID="9"> 7365565626575</cac:ID> </cac:PartyIdentification> <cac:PartyName> <cbc:Name> Moderna produkter AB</cbc:Name> </cac:PartyName> +<cac:Address> +<cac:PartyTaxScheme> +<cac:PartyTaxScheme> +<cac:Contact> </cac:Party> |

Use of code is optional, but it is instrumental to a more extensive use of electronic document exchange. When code is used, each party shall be free to chose the own identification.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | Identifier | 1 |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Party |

| <cac:PartyIdentification> <cac:ID identificationSchemeAgencyID="9"> 7365565626575</cac:ID> </cac:PartyIdentification> |

VAT requirement no. 5

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:Name | Name | 1..n | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Party |

| <cac:PartyName> <cbc:Name> Lillsjö kommun</cbc:Name> </cac:PartyName> |

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | Identifier | 0..1 | ||

| cbc:Postbox | Text | 0..1 | B | |

| cbc:StreetName | Text | 0..1 | B | |

| cbc:Department | Text | 0..1 | B | |

| cbc:CityName | Name | 0..1 | B | |

| cbc:PostalZone | Text | 0..1 | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:AddressLine | Address Line | 0..1 | B | |

| cac:Country | Country | 0..1 | B |

| Class name |

| cac:Party |

| <cac:Address> <cac:ID> 123456789</cac:ID> <cbc:Postbox> Box 37</cbc:Postbox> <cbc:StreetName> Storgatan 5</cbc:StreetName> <cbc:Department> Inköpsavdelningen</cbc:Department> <cbc:CityName> Lillsjö</cbc:CityName> <cbc:PostalZone> 11010</cbc:PostalZone> <cac:AddressLine> <cbc:Line> Extra adressrad</cbc:Line> </cac:AddressLine> <cac:Country> <cac:IdentificationCode> SE</cac:IdentificationCode> </cac:Country> </cac:Address> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:Line | Text | 1..7 | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Address |

| cac:DeliveryAddress |

| <cac:AddressLine> <cbc:Line> Extra adressrad</cbc:Line> <cbc:Line> Extra adressrad</cbc:Line> <cbc:Line> Extra adressrad</cbc:Line> </cac:AddressLine> |

| Field name | Type | Cardinality | Comment | Basic content |

| cac:IdentificationCode | Code | 0..1 | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Address |

| cac:RegistrationAddress |

| cac:DeliveryAddress |

| <cac:Country> <cac:IdentificationCode> SE</cac:IdentificationCode> </cac:Country> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:RegistrationName | Name | 0..1 | ||

| cac:CompanyID | Identifier | 1 | When TaxSchemeID = VAT, state VAT identification number. VAT req. no. 3 - when the seller is a taxable person (under the VAT directive) VAT req. no. 4 - when the customer is liable to pay tax on goods supplied or services rendered, or for internal market goods transaction. When TaxSchemeID = SWT (for seller), state organisation number Required according to Swedish law on public legal persons, or if VAT identification number does not exist. This number is used as part of the seller authenticity checks. | B |

| cbc:ExemptionReason | Text | 0..1 | When TaxSchemeID = SWT (for seller): Applies to invoicing of services in Sweden. By stating "F-skattebevis finns" the seller declares that he is responsible for any income tax on the transaction - in case this information is omitted (and it has not been submitted in some other way) the buyer is responsible to secure and administrate the income tax. | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:RegistrationAddress | Address | 0..1 | When TaxSchemeID = SWT (for seller): Used for information about the place and country, as applicable, where the organisation is legally registered. Country code shall be present for cross-border transactions. Whenever the country code is stated, it is to be used as part of the seller authenticity checks. | B |

| cac:TaxScheme | Tax Scheme | 1 | B |

| Class name |

| cac:Party |

| <cac:PartyTaxScheme> <cbc:RegistrationName> Moderna Produkter AB</cbc:RegistrationName> <cac:CompanyID> 5565624223</cac:CompanyID> <cbc:ExemptionReason> F-skattebevis finns</cbc:ExemptionReason> <cac:RegistrationAddress> <cac:Country> <cac:IdentificationCode> SE</cac:IdentificationCode> </cac:Country> </cac:RegistrationAddress> <cac:TaxScheme> <cac:ID> SWT</cac:ID> </cac:TaxScheme> </cac:PartyTaxScheme> <cac:PartyTaxScheme> <cac:CompanyID> SE556562422301</cac:CompanyID> <cbc:ExemptionReason/> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:PartyTaxScheme> |

When TaxSchemeID = SWT (for seller): Used for information about the place and country, as applicable, where the organisation is legally registered. Country code shall be present for cross-border transactions. Whenever the country code is stated, it is to be used as part of the seller authenticity checks.

| Field name | Type | Cardinality | Comment | Basic content |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:Country |

| Class name |

| cac:PartyTaxScheme |

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | Identifier | 1 | SWT = Income tax payment VAT = Value-added tax | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:PartyTaxScheme |

| cac:TaxCategory |

| <cac:TaxScheme> <cac:ID> SWT</cac:ID> </cac:TaxScheme> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:Name | Name | 0..1 | B | |

| cbc:Telephone | Text | 0..1 | B | |

| cbc:Telefax | Text | 0..1 | B | |

| cbc:ElectronicMail | Text | 0..1 | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Party |

| <cac:Contact> <cbc:Name> Jonas Jonasson</cbc:Name> <cbc:Telephone> 0701111111</cbc:Telephone> <cbc:Telefax> 0365418512</cbc:Telefax> <cbc:ElectronicMail> c@d.se</cbc:ElectronicMail> </cac:Contact> |

| Field name | Type | Cardinality | Comment | Basic content |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:Party | Party | 0..1 | B | |

| cac:AccountsContact | Contact | 0..1 |

| Class name |

| Invoice |

| <cac:SellerParty> <cac:Party> <cac:PartyIdentification> <cac:ID identificationSchemeAgencyID="9"> 7365565626575</cac:ID> </cac:PartyIdentification> <cac:PartyName> <cbc:Name> Moderna produkter AB</cbc:Name> </cac:PartyName> +<cac:Address> <cac:PartyTaxScheme> <cbc:RegistrationName> Moderna Produkter AB</cbc:RegistrationName> <cac:CompanyID> 5565624223</cac:CompanyID> <cbc:ExemptionReason> F-skattebevis finns</cbc:ExemptionReason> <cac:RegistrationAddress> <cac:Country> <cac:IdentificationCode> SE</cac:IdentificationCode> </cac:Country> </cac:RegistrationAddress> <cac:TaxScheme> <cac:ID> SWT</cac:ID> </cac:TaxScheme> </cac:PartyTaxScheme> <cac:PartyTaxScheme> <cac:CompanyID> SE556562422301</cac:CompanyID> <cbc:ExemptionReason/> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:PartyTaxScheme> <cac:Contact> <cbc:Name> Jonas Jonasson</cbc:Name> <cbc:Telephone> 070-1111111</cbc:Telephone> <cbc:Telefax> 0365-418512</cbc:Telefax> <cbc:ElectronicMail> c@d.se</cbc:ElectronicMail> </cac:Contact> </cac:Party> <cac:AccountsContact> <cbc:Name> Evert Larsson</cbc:Name> <cbc:Telephone> 03211234569</cbc:Telephone> <cbc:Telefax> 03219874562</cbc:Telefax> <cbc:ElectronicMail> e@d.se</cbc:ElectronicMail> </cac:AccountsContact> </cac:SellerParty> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:Name | ||||

| cbc:Telephone | ||||

| cbc:Telefax | ||||

| cbc:ElectronicMail |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:SellerParty |

| <cac:Contact> <cbc:Name> Jonas Jonasson</cbc:Name> <cbc:Telephone> 0701111111</cbc:Telephone> <cbc:Telefax> 0365418512</cbc:Telefax> <cbc:ElectronicMail> c@d.se</cbc:ElectronicMail> </cac:Contact> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:ActualDeliveryDateTime | Date Time | 0..1 | VAT req. no. 8 - to be used if other than the invoice date/invoicing period on invoice level. | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:DeliveryAddress | Address | 0..1 | To be used only if delivery is made to other address than the address of the Buyer. This element is not intended for use on invoice line level. | B |

| Class name |

| Invoice |

| cac:InvoiceLine |

| <cac:Delivery> <cbc:ActualDeliveryDateTime> 2001-12-17T09:30:47</cbc:ActualDeliveryDateTime> <cac:DeliveryAddress> <cac:ID> 123456789</cac:ID> <cbc:Postbox> Box 37</cbc:Postbox> <cbc:StreetName> Storgatan 5</cbc:StreetName> <cbc:Department> Inköpsavdelningen</cbc:Department> <cbc:CityName> Lillsjö</cbc:CityName> <cbc:PostalZone> 11010</cbc:PostalZone> <cac:AddressLine> <cbc:Line> Extra adressrad</cbc:Line> </cac:AddressLine> <cac:Country> <cac:IdentificationCode> SE</cac:IdentificationCode> </cac:Country> </cac:DeliveryAddress> </cac:Delivery> |

To be used only if delivery is made to other address than the address of the Buyer. This element is not intended for use on invoice line level.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | ||||

| cbc:Postbox | ||||

| cbc:StreetName | ||||

| cbc:Department | ||||

| cbc:CityName | ||||

| cbc:PostalZone |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:AddressLine | ||||

| cac:Country |

| Class name |

| cac:Delivery |

| <cac:DeliveryAddress> <cac:ID> 123456789</cac:ID> <cbc:Postbox> Box 37</cbc:Postbox> <cbc:StreetName> Storgatan 5</cbc:StreetName> <cbc:Department> Inköpsavdelningen</cbc:Department> <cbc:CityName> Lillsjö</cbc:CityName> <cbc:PostalZone> 11010</cbc:PostalZone> <cac:AddressLine> <cbc:Line> Extra adressrad</cbc:Line> </cac:AddressLine> <cac:Country> <cac:IdentificationCode> SE</cac:IdentificationCode> </cac:Country> </cac:DeliveryAddress> |

| Field name | Type | Cardinality | Comment | Basic content |

| cac:PaymentMeansTypeCode | ||||

| cbc:DuePaymentDate | Date | 0..1 | For invoice: Shall be stated in the transaction. In case of deviation from an agreement made in advance, the buyer has the right to let the rule of the agreement supersede. For credit note: not used | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:PayeeFinancialAccount | Financial Account | 0..1 | Examples of bank identification codes - BIC's: BIC for Bank giro = BGABSESS BIC for Plusgiro = PGSISESS | B |

| cac:PayeePartyName | Party Name | 0..1 | To be used only in case payee differs from the seller/supplier. The buyer should be notified of a payee and his accounts in advance. | B |

| Class name |

| Invoice |

| <cac:PaymentMeans> <cac:PaymentMeansTypeCode> 1</cac:PaymentMeansTypeCode> <cbc:DuePaymentDate> 2004-11-05</cbc:DuePaymentDate> <cac:PayeeFinancialAccount> <cac:ID> 63040</cac:ID> <cac:FinancialInstitutionBranch> <cac:FinancialInstitution> <cac:ID> PGSISESS</cac:ID> </cac:FinancialInstitution> </cac:FinancialInstitutionBranch> </cac:PayeeFinancialAccount> </cac:PaymentMeans> |

Examples of bank identification codes - BIC's: BIC for Bank giro = BGABSESS BIC for Plusgiro = PGSISESS

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | ||||

| cac:PaymentInstructionID |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:FinancialInstitutionBranch |

| Class name |

| cac:PaymentMeans |

| <cac:PayeeFinancialAccount> <cac:ID> 63040</cac:ID> <cac:FinancialInstitutionBranch> <cac:FinancialInstitution> <cac:ID> PGSISESS</cac:ID> </cac:FinancialInstitution> </cac:FinancialInstitutionBranch> <cac:PaymentInstructionID> 54225485</cac:PaymentInstructionID> </cac:PayeeFinancialAccount> |

Use bank identifier code (BIC). Examples: BIC for Swedish Bank giro = BGABSESS BIC for Svedish PlusGiro = PGSISESS

| Field name | Type | Cardinality | Comment | Basic content |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:FinancialInstitution |

| Class name |

| cac:PayeeFinancialAccount |

| <cac:FinancialInstitutionBranch> <cac:FinancialInstitution> <cac:ID> PGSISESS</cac:ID> </cac:FinancialInstitution> </cac:FinancialInstitutionBranch> |

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | Identifier | 0..1 | BIC for bank, Bank giro or Plusgiro | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:FinancialInstitutionBranch |

| <cac:FinancialInstitution> <cac:ID> PGSISESS</cac:ID> </cac:FinancialInstitution> |

To be used only in case payee differs from the seller/supplier. The buyer should be notified of a payee and his accounts in advance.

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:Name |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:PaymentMeans |

| <cac:PayeePartyName> <cbc:Name> Abc</cbc:Name> </cac:PayeePartyName> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:Note | Text | 0..1 | If an advance agreement exists, any corresponding rules in it take precedence. For credit note: not used | B |

| cbc:PenaltySurchargePercent | Percent | 0..1 | To be stated if the seller will request interest compensation in case of delayed payment, expressed as a fixed percentage. If an advance agreement exists, its rules take precedence. Any penalty fees are to be invoiced separately. | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

| <cac:PaymentTerms> <cbc:Note> Betalningsvillkor</cbc:Note> <cbc:PenaltySurchargePercent> 12</cbc:PenaltySurchargePercent> </cac:PaymentTerms> |

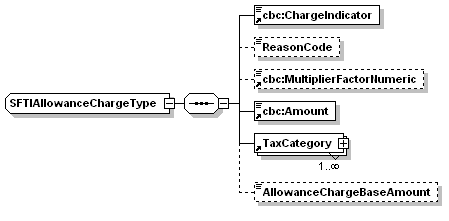

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:ChargeIndicator | Indicator | 1 | B | |

| cac:ReasonCode | Code | 0..1 |

Five kinds of allowance/charge shall be managed in the basic version of Svefaktura (c.f. UN/Edifact 7161):

- Agreed discount

- Expediting fee

- Invoicing fee

- Freight charge

- Small order processing service charge

In order to indicate which kind applies, set ReasonCode to ZZZ (mutually defined) and stat the text in the Name attribute. Example: |

|

| cbc:MultiplierFactorNumeric | Numeric | 0..1 | To be stated as a percentage. The element is used for AllowanceCharge on invoice level only, i.e. not on line level | |

| cbc:Amount | Amount | 1 | B | |

| cac:AllowanceChargeBaseAmount | Amount | 0..1 | Amount on which allowance/charge is calculated |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:TaxCategory | Tax Category | 0..n | The element is used for AllowanceCharge on invoice level only, i.e. not on line level | B |

| Class name |

| Invoice |

| <AllowanceCharge> <cbc:ChargeIndicator> true</cbc:ChargeIndicator> <cac:ReasonCode name="Fraktavgift"> ZZZ</cac:ReasonCode> <cbc:Amount amountCurrencyID="SEK"> 50.00</cbc:Amount> <cac:TaxCategory> <cac:ID> S</cac:ID> <cbc:Percent> 25</cbc:Percent> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:TaxCategory> </AllowanceCharge> |

The element is used for AllowanceCharge on invoice level only, i.e. not on line level

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | Identifier | 1 | VAT requirement. Alternatives E = Exemption S = Standard Note. Subdivisions of tax category S ("standard") is made by means of the tax rate. | B |

| cbc:Percent | Percent | 0..1 | VAT req. no. 9 - Tax rate. The rate is expressed as percentage. For exemption, tax rate is set to 0 (zero). | B |

| cbc:ExemptionReason | Text | 0..1 | VAT req. no. 9 and 11 - where an exemption is involved or where the customer is liable to pay the tax, reference to the appropriate provision of this directive, to the corresponding national provision, or to any indication that the supply is exempt or subject to the reverse charge procedure. Used also in case margin scheme applies. | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:TaxScheme | Tax Scheme | 1 | B |

| Class name |

| AllowanceCharge |

| cac:TaxSubTotal |

| cac:Item |

|

<cac:TaxCategory> <cac:ID> S</cac:ID> <cbc:Percent> 25</cbc:Percent> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:TaxCategory> |

VAT requirement. If the tax amount has to be converted to and shown in a currency different from the invoicing currency.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:SourceCurrencyCode | Code | 1 | If the tax amount has to be converted to and shown in a currency different from the invoicing currency: state currency code for invoicing currency. | B |

| cbc:SourceCurrencyBaseRate | Rate | 0..1 | ||

| cac:TargetCurrencyCode | Code | 1 | If the tax amount has to be converted to and shown in a currency different from the invoicing currency: state currency code for tax currency. | B |

| cbc:TargetUnitBaseRate | Rate | 0..1 | ||

| cbc:CalculationRate | Rate | 0..1 | VAT requirement. If the tax amount has to be converted to and shown in a currency different from the invoicing currency. As rate for currency conversion uses the sales rate (on the applicable currency exchange market in the relevant member state) at the time when the tax takes effect. | B |

| cbc:Date | Date | 0..1 |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

| <cac:ExchangeRate> <cac:SourceCurrencyCode> SEK</cac:SourceCurrencyCode> <cbc:SourceCurrencyBaseRate> 3.141</cbc:SourceCurrencyBaseRate> <cac:TargetCurrencyCode> USD</cac:TargetCurrencyCode> <cbc:TargetUnitBaseRate> 3.14159265</cbc:TargetUnitBaseRate> <cbc:CalculationRate> 3.1415926</cbc:CalculationRate> <cbc:Date> 2005-08-13</cbc:Date> </cac:ExchangeRate> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:TotalTaxAmount | Amount | 1 | Control total. VAT req. no. 10: Total for VAT in invoice. Formula: ∑”Tax amount” for all ”Tax totals” (to be stated even in the total is 0) | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:TaxSubTotal | Tax Sub Total | 0..n | B |

| Class name |

| Invoice |

| <cac:TaxTotal> <cbc:TotalTaxAmount amountCurrencyID="SEK"> 15000.00</cbc:TotalTaxAmount> <cac:TaxSubTotal> <cbc:TaxableAmount amountCurrencyID="SEK"> 15000.00</cbc:TaxableAmount> <cbc:TaxAmount amountCurrencyID="SEK"> 3750.00</cbc:TaxAmount> <cac:TaxCategory> <cac:ID> S</cac:ID> <cbc:Percent> 25.0</cbc:Percent> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:TaxCategory> <cac:TaxCurrencyTaxAmount amountCurrencyID="SEK"> 3750.00</cac:TaxCurrencyTaxAmount> </cac:TaxSubTotal> </cac:TaxTotal> |

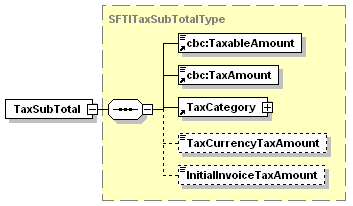

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:TaxableAmount | Amount | 1 | VAT requirement no. 8 - taxable amount per tax rate or exemption. Formula: ∑”Line item amount” for the relevant tax rate + ∑”Charges on invoice level with the relevant tax rate” - ∑”Allowances on invoice level with the relevant tax rate” | B |

| cbc:TaxAmount | Amount | 1 | The initial VAT requirement by the Swedish Tax Authority: Total tax amount per tax category and tax rate. Formula: ”Taxable amount” x ”Tax rate” / 100 for tax category = S; 0 for tax category = E | B |

| cac:TaxCurrencyTaxAmount | Amount | 0..1 | VAT requirement, and also the initial requirement by the Swedish Tax Authority: If the invoice is expressed in other currency than the tax subject's official accounting currency, and the accounting currency is other than Swedish krona or euro, the tax amount is to be expressed also in the accounting currency. If the tax subject has a different accounting currency than Swedish krona or euro, and the invoicing currency is other than Swedish krona, the tax amount is to be expressed also in Swedish krona. In case of conversion, also the exchange rate is required. Formula: ”Tax amount” x ”Exchange rate”. The amount is to be presented in the currency given by ”VAT currency” | B |

| cac:InitialInvoiceTaxAmount |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:TaxCategory | Tax Category | 1 | B |

| Class name |

| cac:TaxTotal |

| <cac:TaxSubTotal> <cbc:TaxableAmount amountCurrencyID="SEK"> 15000.00</cbc:TaxableAmount> <cbc:TaxAmount amountCurrencyID="SEK"> 3750.00</cbc:TaxAmount> <cac:TaxCategory> <cac:ID> S</cac:ID> <cbc:Percent> 25.0</cbc:Percent> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:TaxCategory> <cac:TaxCurrencyTaxAmount amountCurrencyID="SEK"> 3750.00</cac:TaxCurrencyTaxAmount> <cac:InitialInvoiceTaxAmount amountCurrencyID="SEK"> 50</cac:InitialInvoiceTaxAmount> </cac:TaxSubTotal> |

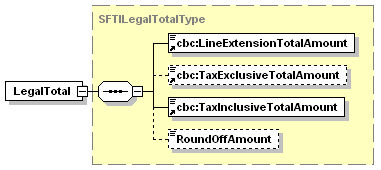

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:LineExtensionTotalAmount | Amount | 1 | Control total. Formula: ∑”Line item amount” (That is, the net amounts on invoice line) | B |

| cbc:TaxExclusiveTotalAmount | Amount | 0..1 | Control total. Formula: ∑”Line item amount” + ∑”Charges on the invoice as a whole” - ∑”Allowances for the invoice as a whole” | B |

| cbc:TaxInclusiveTotalAmount | Amount | 1 | The amount to pay inclusive of taxes. The amount may be rounded to an appropriate unit of the invoicing currency (a prerogative of the issuer of the invoice). Formula: ”Total invoice amount excl of VAT + ”Total VAT amount" + ( any ”Invoice total round-off amount”) | B |

| cac:RoundOffAmount | Amount | 0..1 | To be used if the seller's system cannot handle exact amounts down the smallest fraction (sub-unit) of the invoicing currency. Example: if in Swedish currency "ören" is rounded to nearest "krona", -0,49<= Invoice total round-off amount <= +0,50. Only invoice amount to pay can be rounded in this way. (Note. the purpose of this amount is similar but yet different from the rounding mechanism applied in calculations.) | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

| <cac:LegalTotal> <cbc:LineExtensionTotalAmount amountCurrencyID="SEK"> 4000</cbc:LineExtensionTotalAmount> <cbc:TaxExclusiveTotalAmount amountCurrencyID="SEK"> 3815</cbc:TaxExclusiveTotalAmount> <cbc:TaxInclusiveTotalAmount amountCurrencyID="SEK"> 4769</cbc:TaxInclusiveTotalAmount> <cac:RoundOffAmount amountCurrencyID="SEK"> 0.25</cac:RoundOffAmount> </cac:LegalTotal> |

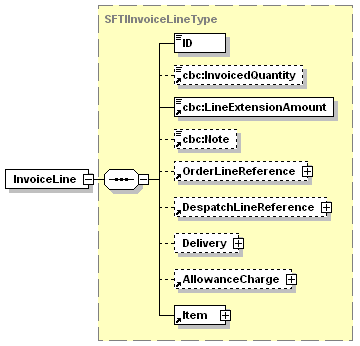

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | Identifier | 1 | Sequential number | B |

| cbc:InvoicedQuantity | Quantity | 0..1 | VAT req. no. 6 - quantity of goods supplies or extent of services rendered. It is recommended to use measure unit codes according to UN/ECE Rec.20, if not manageable omit code/code list and use text, abbreviation, etc. | B |

| cbc:LineExtensionAmount | Amount | 1 | VAT req. no. 8. Line item net amount, incl any allowance/charge but exclusive of VAT. UBL requires an amount on each line item. Formula: no automatic calculation is required for the basic version of Svefaktura. If automatic calculation/check is agreed, the formula shall follow: unit price x invoiced quantity / unit price basis minus discounts (if these are used). Line item amount is rounded as necessary to the number of decimal positions handled in the invoicing currency. | B |

| cbc:Note | Text | 0..1 | Textual information regarding the invoice line. If specific elements exist, they should be instead of the text. Example of content: - Packaging information, when relevant - Descriptive information related to of goods/service, other than article description - URL reference to information related to this invoice line (NB! be careful not to place information on a web site if it need to be stored with the invoice for verification purposes) - Information regarding excises, duties, etc. | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:OrderLineReference | Order Line Reference | 0..1 | ||

| cac:DespatchLineReference | Line Reference | 0..1 | In case delivery notes exist they should be stated for verification by the buyer. Delivery notes are not to be used as substitute for specification in the invoice. At most one delivery note can be given for each invoice line: - If only one delivery note applies for the invoice, the reference is specified on invoice level. - If several delivery notes apply, the references are either listed per on invoice level or listed here with one reference per invoice line. | B |

| cac:Delivery | Delivery | 0..1 | B | |

| cac:AllowanceCharge | Allowance Charge | 0..1 | VAT req. no. 8: Any discount is to be included in the line item amount. | B |

| cac:Item | Item | 1 | B |

| Class name |

| Invoice |

| <cac:InvoiceLine> <cac:ID> 1</cac:ID> <cbc:InvoicedQuantity quantityUnitCodeListAgencyID="6" quantityUnitCodeListID="UNECE-REC20" quantityUnitCode="LTR"> 120</cbc:InvoicedQuantity> <cbc:LineExtensionAmount amountCurrencyID="SEK"> 6000</cbc:LineExtensionAmount> <cbc:Note> Information om fakturaraden</cbc:Note> +<cac:OrderLineReference> +<cac:DespatchLineReference> +<cac:Delivery> <cac:AllowanceCharge> <cbc:ChargeIndicator> false</cbc:ChargeIndicator> <cbc:Amount amountCurrencyID="SEK"> 5</cbc:Amount> <cac:AllowanceChargeBaseAmount amountCurrencyID="SEK"> 6000</cac:AllowanceChargeBaseAmount> </cac:AllowanceCharge> +<cac:Item> </cac:InvoiceLine> |

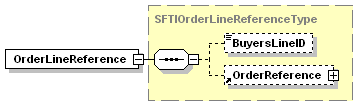

| Field name | Type | Cardinality | Comment | Basic content |

| cac:BuyersLineID | Identifier | 0..1 |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:OrderReference | Order Reference | 0..1 |

| Class name |

| cac:InvoiceLine |

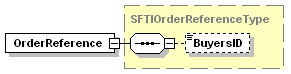

| Field name | Type | Cardinality | Comment | Basic content |

| cac:BuyersID | Identifier | 0..1 |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:OrderLineReference |

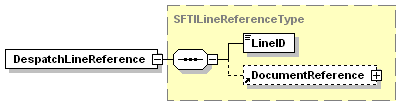

In case delivery notes exist they should be stated for verification by the buyer. Delivery notes are not to be used as substitute for specification in the invoice. At most one delivery note can be given for each invoice line: - If only one delivery note applies for the invoice, the reference is specified on invoice level. - If several delivery notes apply, the references are either listed per on invoice level or listed here with one reference per invoice line.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:LineID |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:DocumentReference |

| Class name |

| cac:InvoiceLine |

| <cac:DespatchLineReference> <cac:LineID> 1</cac:LineID> <cac:DocumentReference> <cac:ID> 7</cac:ID> </cac:DocumentReference> </cac:DespatchLineReference> |

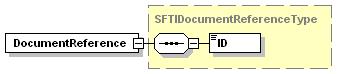

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | Identifier | 1 | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:DespatchLineReference |

| <cac:DocumentReference> <cac:ID> 7</cac:ID> </cac:DocumentReference> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:ChargeIndicator | Indicator | 1 | B | |

| cbc:Amount | Amount | 1 | B | |

| cac:AllowanceChargeBaseAmount | Amount | 0..1 | Amount on which allowance/charge is calculated |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:InvoiceLine |

| <AllowanceCharge> <cbc:ChargeIndicator> true</cbc:ChargeIndicator> <cac:ReasonCode name="Fraktavgift"> ZZZ</cac:ReasonCode> <cbc:Amount amountCurrencyID="SEK"> 50.00</cbc:Amount> <cac:TaxCategory> <cac:ID> S</cac:ID> <cbc:Percent> 25</cbc:Percent> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:TaxCategory> </AllowanceCharge> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:Description | Text | 0..1 | VAT req. No. 6 - the nature of goods supplied or services rendered (if not given as free text in Note). | B |

| Class name | Type | Cardinality | Comment | Basic content |

| cac:BuyersItemIdentification | Item Identification | 0..1 | Several article numbers (according to different numbering systems) may be given. If used, the supplier's system is the first-hand option. | |

| cac:SellersItemIdentification | Item Identification | 0..1 | Several article numbers (according to different numbering systems) may be given. If used, the supplier's system is the first-hand option. | |

| cac:StandardItemIdentification | Item Identification | 0..1 | Several article numbers (according to different numbering systems) may be given. If used, the supplier's system is the first-hand option. In case of a standard numbering system, also indicate which standard. | |

| cac:TaxCategory | Tax Category | 0..1 | B | |

| cac:BasePrice | Base Price | 0..1 | B |

| Class name |

| cac:InvoiceLine |

| <cac:Item> <cbc:Description> Falu rödfärg</cbc:Description> <cac:BuyersItemIdentification> <cac:ID> 123</cac:ID> </cac:BuyersItemIdentification> <cac:SellersItemIdentification> <cac:ID> 456</cac:ID> </cac:SellersItemIdentification> <cac:StandardItemIdentification> <cac:ID identificationSchemeAgencyID="9"> 7305424567898</cac:ID> </cac:StandardItemIdentification> <cac:TaxCategory> <cac:ID> S</cac:ID> <cbc:Percent> 25.0</cbc:Percent> <cbc:ExemptionReason/> <cac:TaxScheme> <cac:ID> VAT</cac:ID> </cac:TaxScheme> </cac:TaxCategory> <cac:BasePrice> <cbc:PriceAmount amountCurrencyID="SEK"> 5</cbc:PriceAmount> <cbc:BaseQuantity quantityUnitCodeListAgencyID="6" quantityUnitCodeListID="UNECE-REC20" quantityUnitCode="LTR"> 1</cbc:BaseQuantity> </cac:BasePrice> </cac:Item> |

Several article numbers (according to different numbering systems) may be given. If used, the supplier's system is the first-hand option.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Item |

| <cac:BuyersItemIdentification> <cac:ID> 123</cac:ID> </cac:BuyersItemIdentification> |

Several article numbers (according to different numbering systems) may be given. If used, the supplier's system is the first-hand option.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Item |

| <cac:SellersItemIdentification> <cac:ID> 456</cac:ID> </cac:SellersItemIdentification> |

Several article numbers (according to different numbering systems) may be given. If used, the supplier's system is the first-hand option. In case of a standard numbering system, also indicate which standard.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Item |

| <cac:StandardItemIdentification> <cac:ID identificationSchemeAgencyID="9"> 7305424567898</cac:ID> </cac:StandardItemIdentification> |

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:PriceAmount | Amount | 1 | VAT req. no. 8 - unit price is to be handled with up to 4 decimal places. | B |

| cbc:BaseQuantity | Quantity | 0..1 | To be used if unit price is not set per one unit and the amount on the invoice line is calculated/checked automatically. |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| cac:Item |

| <cac:BasePrice> <cbc:PriceAmount amountCurrencyID="SEK"> 5</cbc:PriceAmount> <cbc:BaseQuantity quantityUnitCodeListAgencyID="6" quantityUnitCodeListID="UNECE-REC20" quantityUnitCode="LTR"> 1</cbc:BaseQuantity> </cac:BasePrice> |

The requisitionist's reference is defined by the buyer for the sole purpose of forwarding a received invoice to the correct person/unit in charge within the buyer's organisation. This reference may be used for per transaction or used repeatedly in invoices (or periodic invoices) - a guide will be made separately. Normally only one reference should be used. Requisitionist's reference no. 2 is used only if Requisitionist's reference no.1 is not administered centrally in buyer's organisation. It can be used to identify an organisational unit, a project, etc.

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID | 1 | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

| <RequisitionistDocumentReference> <cac:ID> Skolmatsalen</cac:ID> </RequisitionistDocumentReference> |

| Field name | Type | Cardinality | Comment | Basic content |

| cac:ID |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

Information on how the delivery was made; means of delivery; etc.

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:SpecialTerms | Text | 0..1 | B |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

| <cac:DeliveryTerms> <cbc:SpecialTerms> Enligt avtal</cbc:SpecialTerms> </cac:DeliveryTerms> |

The period is to be stated in case of periodic invoicing and for continuous supply of goods and services. This period information applies to the whole invoice, alternatively the relevant delivery times can be stated per invoice line. Cf. also tax point date. A period is also needed in credit notes crediting several invoices when the initial invoices are not referred to individually (and this is in agreement with the Tax Authority's requirements). See comment to ”Invoice reference”

| Field name | Type | Cardinality | Comment | Basic content |

| cbc:StartDateTime | ||||

| cbc:EndDateTime |

| Class name | Type | Cardinality | Comment | Basic content |

| Class name |

| Invoice |

| <InvoicingPeriod> <cbc:StartDateTime> 2005-12-17</cbc:StartDateTime> <cbc:EndDateTime> 2005-12-26</cbc:EndDateTime> </InvoicingPeriod> |